Building the Infrastructure for the Longevity Economy: How Silva Dayan Leads Time

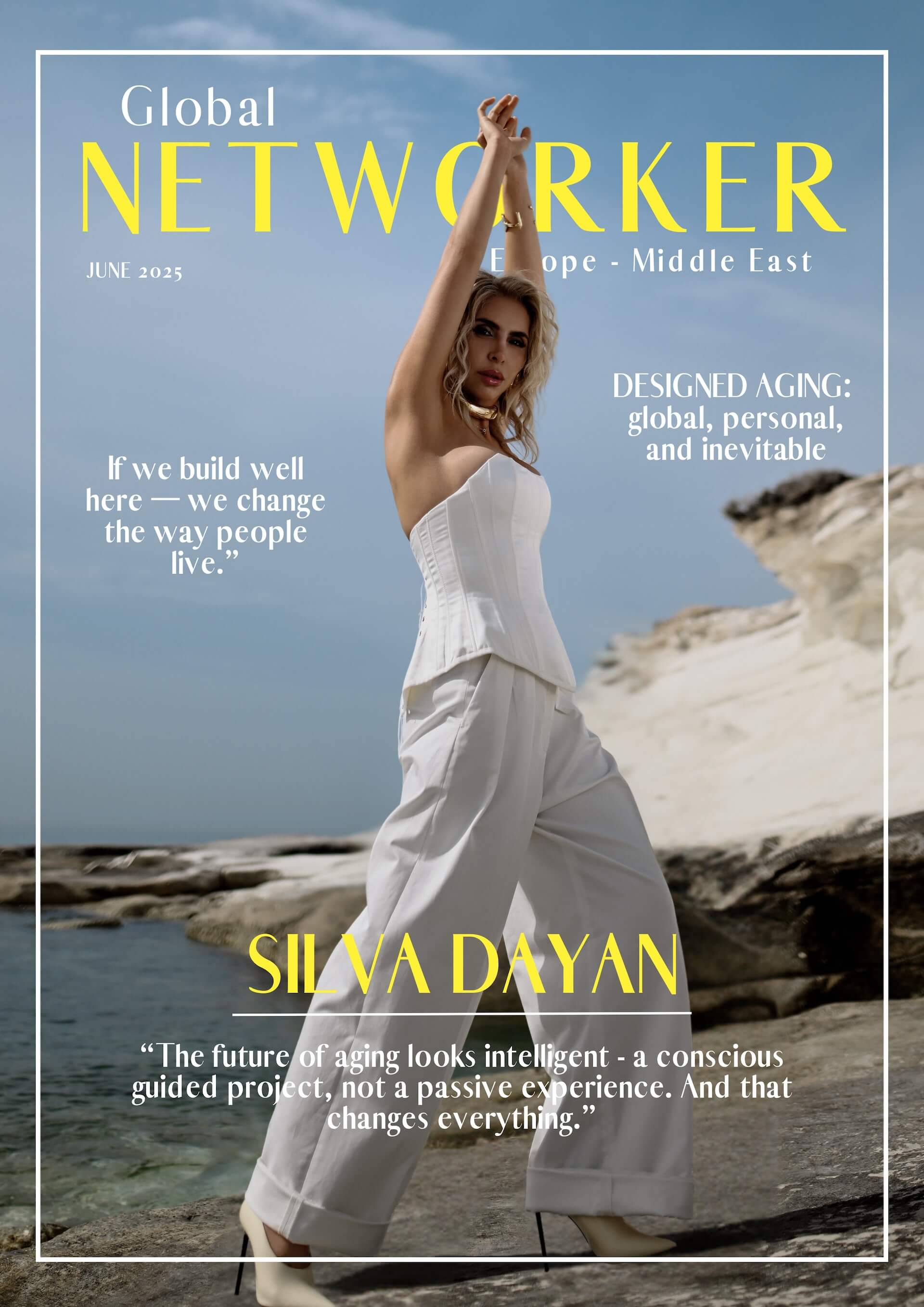

ON THE COVER: Silva Dayan

In a world where traditional healthcare models are being redefined, Silva Dayan, President of the World Anti-Aging Association (WAAA), is positioning her platform as the institutional backbone of a new global industry: strategic aging. With a unique blend of scientific structure, business foresight, and ecosystem design, Silva Dayan is leading WAAA into a space where aging becomes both an asset and a category of long-term investment.

We spoke to Silva Dayan about the economic logic behind the longevity business, the structure of WAAA’s B2B2C model, and what investors should know before the space reaches full maturity.

Let’s begin with the fundamentals. What is WAAA and what problem does it solve?

WAAA is a global platform that standardizes and scales age management. We’re neither a clinic, nor a product brand. We’re the infrastructure behind those, i.e., the certification, protocols, partnerships, and education that enable this sector to operate with clarity and consistency. Our core belief is that aging is no longer a passive condition — it’s a strategically managed system.

The problem today is fragmentation. Longevity is a buzzword, but few operate with evidence-based frameworks, accountability, or metrics. That limits trust, and ultimately scalability. We built WAAA to close that gap.

What does that mean operationally?

It means we enable age management as a business function. Through our certification frameworks, digital protocols, and licensing agreements, we create the conditions for clinics, digital platforms, biotech startups, and wellness providers to offer consistent, measurable services. We connect science and delivery. In practical terms, a clinic in Zurich, a spa in Dubai, or a diagnostics lab in Miami can all operate under the same set of validated protocols — with shared outcomes data and standardized compliance.

Silva Dayan, Photographer: Harris Kyprianou

From a macroeconomic perspective, why is this the right time to invest in longevity infrastructure?

Several reasons. First, demographics: the global population is aging fast. The World Health Organization predicts that by 2050, nearly one in six people globally will be over the age of 65. Second, cost pressure: healthcare systems are moving from treatment to prevention. Third, consumer shift: high-net-worth individuals are allocating capital toward vitality, not vanity. Such behaviours reflect a growing interest in innovative and fast-growing companies, including those in the health and wellness sectors.

All of this makes longevity more than a trend — it becomes a category with cross-sectoral impact: biotech, real estate, digital health, insurance, and even HR. We’re building the connective tissue.

You mentioned “asset class” earlier. Can longevity really function like that?

Yes, when structured correctly. We don’t view aging as a variable. We view it as a system of trackable, optimizable indicators, i.e., metabolic function, cognitive capacity, inflammation, etc. When you track them longitudinally across populations, they become a biological P&L. That’s extremely attractive to insurers, employers, sovereign funds, and private investors alike.

With the right structure, like what WAAA provides, you turn age management into a repeatable, monetizable, and investable experience. That’s how longevity becomes an asset class.

Silva Dayan, Photographer: Harris Kyprianou

How do you evaluate the broader opportunity — both in market size and long-term relevance?

The longevity sector is moving from fragmented wellness spending to structured, high-value infrastructure. Global estimates already value the preventive and longevity market at over $600 billion, but that’s a conservative figure. What’s really scaling is cross-industry integration — biotech, diagnostics, real estate, workforce performance, and insurance are all converging around aging as a controllable variable.

There’s also the sustainability layer. Aging populations are creating structural pressure on healthcare, pensions, and productivity.

Age management isn’t just a wellness solution — it’s part of future-proofing human systems. Any economy with rising life expectancy needs a model for performance longevity. That’s where we operate.

Silva Dayan, Photographer: Harris Kyprianou

From an investment perspective, how do you measure value and performance?

We focus on repeatability, data precision, and downstream scalability. Our core metrics include: Client Retention across B2B and B2C verticals; Protocol Compliance Rates among licensed professionals; Biological Outcome Indices such as biomarkers, resilience scores, metabolic age; Per-Provider Revenue and License Margin; Return on Biological Investment (RBI) linking intervention to functional gain; and, obviously, Lifetime Value (LTV) per market.

These indicators are built to align with what institutional investors, insurers, and public health partners need: predictability, impact, and traceable ROI. We’re not selling treatments, we’re scaling infrastructure.

What is the average investment window?

This is a long-cycle play. You don’t get exponential return in 12 months, but over a 3–7 year window you build serious equity — in trust, data, and partnerships. Our current growth partners are positioning for platform integrations, M&A, and secondary offerings within that horizon.

What kind of investors are you looking for now?

Smart capital — not just valuation-chasing. We want partners who understand health strategy, long-term playbooks, and sector design. If you’ve invested in fintech infrastructure, edtech standardization, or digital health, you’ll immediately see what we’re building. We’re looking for alignment.

Final question. You’ve said aging isn’t something to fight — it’s something to design. How does that tie into your business vision?

The new value chain is biological performance. Those who design aging will control a major part of the health economy — just like those who designed financial infrastructure in the last wave. WAAA is not here to compete on products. We’re here to define the system.

Silva Dayan, Photographer: Harris Kyprianou